As eth crypto forecast takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. Ethereum stands as a cornerstone of the cryptocurrency realm, distinguishing itself with unique features such as smart contracts and decentralized applications. With a robust market position, its trading volume and capitalizations have seen significant fluctuations, making it essential to examine the current trends and future potential of this versatile cryptocurrency.

In this discussion, we’ll delve into the recent price movements of Ethereum, explore fundamental factors influencing its future, and analyze the tools and methods for forecasting its price. Additionally, we’ll consider the market sentiment and expert opinions that shape the narrative around Ethereum’s growth and challenges.

Overview of Ethereum and Its Market Position

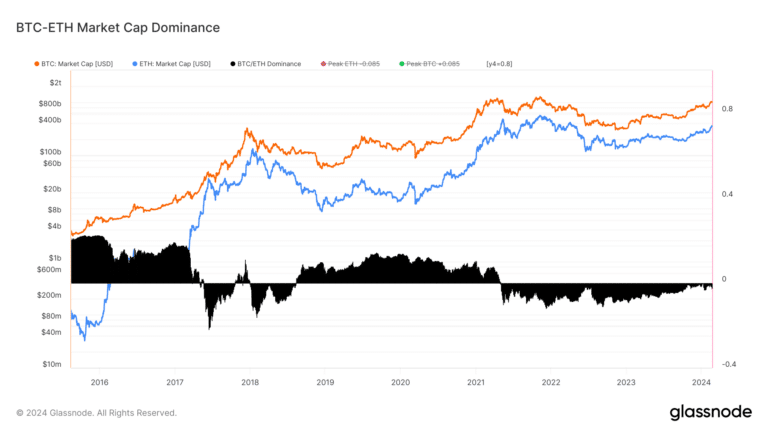

Ethereum has emerged as a cornerstone of the cryptocurrency ecosystem since its inception in 2015. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum is a versatile platform that enables the creation of decentralized applications (dApps) and smart contracts. This unique feature has positioned Ethereum as a leader in blockchain technology, fostering innovation in various industries from finance to gaming.In terms of market capitalization, Ethereum consistently ranks second after Bitcoin, boasting a market cap of approximately $200 billion as of October 2023.

Over the past year, Ethereum’s trading volume has fluctuated significantly, peaking during periods of heightened market activity and interest in decentralized finance (DeFi). Such metrics underline Ethereum’s critical role in the crypto market and its ongoing evolution.

Current Trends in Ethereum Prices

Recent price movements for Ethereum have been marked by volatility, reflecting broader trends in the cryptocurrency market. Over the last few months, Ethereum’s price experienced a surge, climbing from around $1,800 to highs exceeding $3,000 amid increasing institutional interest and adoption of its underlying technology. Several factors influence these price fluctuations, including market sentiment, regulatory news, and technological advancements. Compared to Bitcoin, which often sets the market tone, Ethereum’s price movements can be more reactive to developments in the DeFi space and NFT (Non-Fungible Token) markets, often resulting in sharper price swings.

Fundamental Factors Affecting Ethereum’s Future

Several key technological developments are anticipated to impact Ethereum’s growth trajectory. The Ethereum 2.0 upgrade, transitioning from proof-of-work to proof-of-stake, aims to enhance scalability and reduce energy consumption. This transition is expected to bolster Ethereum’s adoption among environmentally-conscious investors.Regulatory changes also hold significant potential to influence Ethereum’s future. As governments worldwide begin to establish clearer guidelines for cryptocurrencies, Ethereum’s compliance with these regulations could either facilitate its growth or present challenges.Furthermore, the burgeoning decentralized finance (DeFi) sector is shaping Ethereum’s market trends.

With billions locked in DeFi protocols, Ethereum’s ecosystem is becoming increasingly entrenched in the financial services landscape, further solidifying its importance in the crypto space.

Forecasting Tools and Methods for Ethereum Prices

Various analytical methods are utilized for forecasting Ethereum prices, each with its strengths and weaknesses. Some of the most common methods include technical analysis, fundamental analysis, and sentiment analysis. Technical analysis relies on historical price data and chart patterns to make predictions, while fundamental analysis considers external factors such as technological advancements and market sentiment. Sentiment analysis involves gauging investor emotions and reactions to news events.Here is a comparison of different forecasting methods and their accuracy:

| Method | Description | Accuracy |

|---|---|---|

| Technical Analysis | Utilizes charts and historical data | Moderate |

| Fundamental Analysis | Focuses on intrinsic value and news impacts | High in stable markets |

| Sentiment Analysis | Analyzes public sentiment from social media and news | Variable |

Influential Market Sentiment Indicators

Market sentiment plays a crucial role in influencing Ethereum’s price movements. Positive sentiment can drive prices higher, while negative sentiment can lead to sharp declines. Key sentiment indicators that traders commonly monitor include the Fear & Greed Index, social media trends, and trading volume.To effectively gauge market sentiment regarding Ethereum, investors should consider the following metrics:

- Fear & Greed Index

- Social Media Mentions

- Trading Volume Changes

- Market Dominance Percentage

Long-term Predictions for Ethereum

Expert predictions for Ethereum’s price over the next few years vary widely, reflecting the inherent uncertainty of the cryptocurrency market. Some analysts forecast that Ethereum could potentially reach $10,000 by 2025, driven by increasing adoption and the success of Ethereum 2.0.Potential scenarios for Ethereum’s market cap growth include increased institutional investment and the expanded use of Ethereum for various applications, particularly in DeFi and NFTs.

The implications of technological upgrades, such as the full implementation of Ethereum 2.0, could further enhance its scalability and drive demand.

Risks and Challenges for Ethereum Investors

Investing in Ethereum comes with its share of risks that could impact future performance. Major risks include regulatory scrutiny, competition from other blockchain platforms, and network congestion issues. Challenges faced by Ethereum’s network and community can include delays in upgrades and potential security vulnerabilities as the ecosystem grows. Here’s a list of risks alongside potential mitigation strategies for investors:

| Risk | Mitigation Strategy |

|---|---|

| Regulatory Uncertainty | Diversify investments and stay informed |

| Network Congestion | Invest in layer-2 solutions |

| Market Volatility | Implement risk management strategies |

Community Insights and Expert Opinions

Community sentiment is pivotal in shaping Ethereum’s market dynamics. The engaged community of developers, investors, and users contributes to the overall perception and acceptance of Ethereum. Insights from industry experts further enrich the understanding of Ethereum’s future potential.One prominent figure in the cryptocurrency space, Vitalik Buterin, co-founder of Ethereum, recently stated, “The future of Ethereum is bright, as we continue to innovate and adapt to the evolving needs of our users.” This statement reflects optimism about Ethereum’s adaptability and ongoing relevance in the crypto market.

Final Thoughts

As we wrap up our exploration of the eth crypto forecast, it becomes evident that Ethereum’s future is shaped by both promise and uncertainty. While technological advancements and market dynamics present exciting prospects, investors must remain vigilant of the inherent risks and challenges. The insights gathered from experts and community sentiment will continue to play a pivotal role in determining Ethereum’s trajectory in the coming years.

Q&A

What is Ethereum’s current market position?

Ethereum is one of the leading cryptocurrencies, consistently ranking second by market capitalization after Bitcoin.

How do smart contracts work on Ethereum?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, enabling trustless transactions on the Ethereum blockchain.

What is Ethereum 2.0?

Ethereum 2.0 is an upgrade aimed at improving the scalability and security of the network by transitioning from a proof-of-work to a proof-of-stake consensus mechanism.

How does decentralized finance (DeFi) impact Ethereum?

DeFi leverages Ethereum’s blockchain to create financial services without traditional intermediaries, increasing Ethereum’s utility and driving demand for its tokens.

What are the risks associated with investing in Ethereum?

Risks include market volatility, regulatory changes, and technological issues that could impact Ethereum’s network and adoption.