As the ethereum vs bitcoin future takes center stage, this discussion invites readers into the fascinating world of cryptocurrencies, where two giants continue to evolve and shape the digital landscape.

Ethereum and Bitcoin represent two different philosophies in the blockchain ecosystem. While Bitcoin serves primarily as a digital currency and store of value, Ethereum extends its functionality to support decentralized applications and smart contracts. Understanding their historical development, technological differences, and adoption scenarios provides a clearer picture of what lies ahead for both currencies.

Overview of Ethereum and Bitcoin

Both Ethereum and Bitcoin are pivotal players in the cryptocurrency landscape, each serving unique purposes and employing different technologies. Bitcoin, launched in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency and primarily functions as a digital currency and store of value. On the other hand, Ethereum, created in 2015 by Vitalik Buterin and his team, extends the concept of cryptocurrency by introducing smart contracts, enabling developers to build decentralized applications (dApps) on its platform.Historically, Bitcoin has set the benchmark for cryptocurrencies, influencing market trends and investor behavior.

As the first mover, its growth has been meteoric, often referred to as “digital gold.” Ethereum, however, has carved out its niche by fostering an ecosystem of innovation. The Ethereum blockchain has led to the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), transforming how digital assets are created, traded, and utilized. Both platforms enjoy strong community support, but Ethereum’s developer engagement is particularly notable, with a vibrant community continually pushing the boundaries of what’s possible.

Technological Differences

Understanding the technological nuances between Ethereum and Bitcoin is essential for grasping their distinct roles in the market. The fundamental differences lie in their consensus mechanisms and transaction capabilities. Bitcoin uses the Proof of Work (PoW) consensus mechanism, which requires computational power to validate transactions and secure the network. In contrast, Ethereum is transitioning to a Proof of Stake (PoS) model, which allows validators to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.Transaction processing speeds also differ significantly.

Bitcoin processes transactions approximately every 10 minutes, while Ethereum can handle transactions in about 15 seconds. This faster processing speed gives Ethereum an edge when it comes to scalability, although both networks are exploring solutions to enhance their capacities. Bitcoin is focusing on the Lightning Network, while Ethereum has introduced Layer 2 solutions like Optimistic Rollups and zk-Rollups.

Use Cases and Adoption

The use cases for Ethereum and Bitcoin highlight their unique value propositions. Bitcoin is primarily viewed as a store of value or “digital gold,” attracting investors looking for a hedge against inflation. Conversely, Ethereum’s versatility allows it to power a myriad of applications, including DeFi platforms, gaming, and supply chain management.Numerous projects built on Ethereum have gained traction, such as Uniswap (a decentralized exchange), Aave (a lending platform), and Chainlink (a decentralized oracle network).

These innovations have significantly influenced the blockchain ecosystem, showcasing Ethereum’s capability to support complex digital interactions beyond mere transactions. Businesses ranging from startups to established enterprises are increasingly adopting Ethereum for its smart contract functionalities, while Bitcoin finds favor among individual investors and institutions seeking long-term value.

Market Trends and Future Predictions

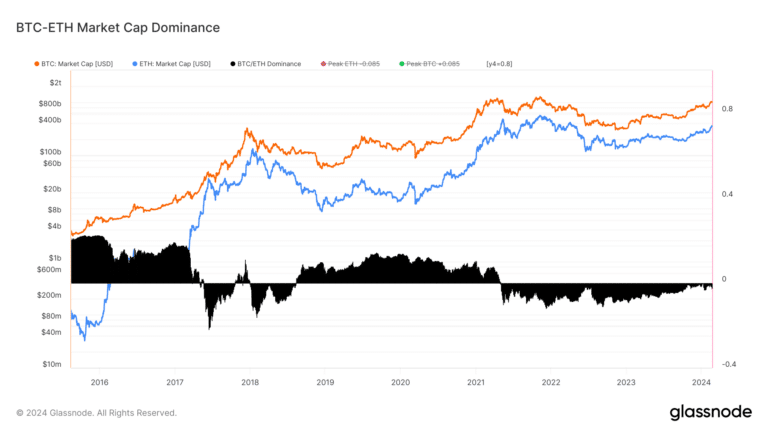

Recent market trends indicate a growing divergence in the performance of Ethereum and Bitcoin. Bitcoin has maintained its position as the market leader in terms of market capitalization, yet Ethereum’s rapid growth in utility and applications has led to increased interest from investors. Analysts predict that if the current trends continue, Ethereum could see significant price appreciation due to its evolving ecosystem and widespread adoption.Experts express mixed opinions on the long-term sustainability of both cryptocurrencies.

While Bitcoin may continue to dominate as a store of value, Ethereum’s adaptability and robust developer community position it well for future growth. Predictions suggest that Ethereum’s market value could potentially surpass Bitcoin’s if it consistently enhances its technological capabilities and addresses scalability challenges effectively.

Regulatory Environment

The regulatory landscape plays a crucial role in shaping the future of Ethereum and Bitcoin. Different regions have implemented varying regulations that impact both cryptocurrencies. For instance, the U.S. has seen regulatory scrutiny concerning securities laws and taxation, affecting how cryptocurrencies are classified and traded. Countries like El Salvador have embraced Bitcoin as legal tender, while others impose strict regulations that stifle innovation.Regulatory changes can significantly influence the development trajectory of both cryptocurrencies.

Compliance with local laws may create barriers to entry for new projects but can also foster a safer investment environment, encouraging broader adoption. A proactive approach toward regulation could lead to more institutional involvement in both Ethereum and Bitcoin, ultimately benefiting their ecosystems.

Investment Considerations

When considering investments in Ethereum and Bitcoin, it’s essential to examine the associated risks. Here is a comparison table outlining the investment risks for both cryptocurrencies:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| Volatility | High | Very High |

| Regulatory Risk | Moderate | High |

| Market Maturity | High | Moderate |

| Technology Evolution | Slow | Rapid |

| Use Case Adoption | Strong | Growing |

Investors should consider diversifying their portfolios by allocating funds to both cryptocurrencies to mitigate risks. Each cryptocurrency presents its advantages and disadvantages; Bitcoin’s stability contrasts with Ethereum’s potential for explosive growth driven by innovation. Careful analysis of individual investment goals and risk tolerance is crucial for making informed decisions in this dynamic market.

Community and Ecosystem Development

Community governance plays a fundamental role in the evolution of both Ethereum and Bitcoin. The decentralized nature of these networks allows community members to participate in decision-making processes, shaping the future direction of each cryptocurrency. For instance, Bitcoin’s development is largely driven by Bitcoin Improvement Proposals (BIPs), where community members propose changes or upgrades.Ethereum, on the other hand, has numerous community-led initiatives such as Ethereum Improvement Proposals (EIPs) that focus on enhancing the platform’s functionality.

These initiatives reflect a strong commitment to innovation, with constant collaboration among developers.The developer ecosystem is essential for driving technological advancement. Ethereum boasts a larger number of active developers compared to Bitcoin, which has led to a more diverse range of applications and solutions. This vibrant ecosystem fosters innovation that could redefine industries and expand the use of blockchain technology far beyond its original scope.

Closing Notes

In conclusion, the future of Ethereum and Bitcoin remains intertwined yet distinct, with each cryptocurrency carving its own path in the evolving market. As technological advancements, regulatory changes, and community engagement continue to shape their trajectories, investors and users alike must stay informed to navigate the complexities of this dynamic landscape.

FAQ Overview

What are the main differences between Ethereum and Bitcoin?

Ethereum focuses on enabling smart contracts and decentralized applications, while Bitcoin is primarily a digital currency designed for transactions and value storage.

Which cryptocurrency has a greater potential for future growth?

Both cryptocurrencies have unique potentials; Ethereum’s development in decentralized finance (DeFi) and Bitcoin’s status as digital gold contribute to their growth trajectories.

How do transaction speeds compare between Ethereum and Bitcoin?

Ethereum generally offers faster transaction speeds, especially with its ongoing upgrades, while Bitcoin transactions can take longer due to its block size and time constraints.

What role does community governance play in these cryptocurrencies?

Community governance is crucial for both Ethereum and Bitcoin, as it influences decision-making processes and development directions through proposals and consensus among participants.

Are there specific investment risks associated with Ethereum and Bitcoin?

Yes, investment risks include market volatility, regulatory changes, technological vulnerabilities, and differing adoption rates, which can affect the value and stability of each cryptocurrency.

.png)